Challenges to Launching an OTT Service

February 6, 2017

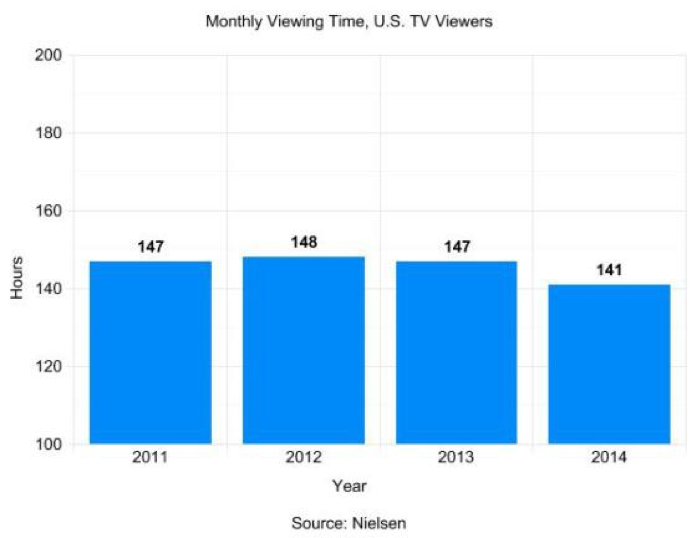

In 2013, traditional pay TV services had their best year ever, pulling in over $102 billion in revenues. Unfortunately, according to MediaPost, the numbers have been declining ever since. In 2013, Time Magazine reported, viewers watched an average of 147 hours of live TV per month in the third quarter. One year later, they were watching 141 hours, six hours less on average.

Where were those viewers spending their viewing hours?

Table of Contents:

But it has been, until recently, a niche demographic. That appears to be finally changing. Time reports that 2.6 million households are now broadband only. This number has more than doubled from the previous year. Even more troubling, however, is the rise of so-called ‘cord-nevers’, viewers who have never subscribed to any form of traditional pay-TV at all.

This is overwhelmingly a younger cohort. According to Comscore’s “US Total Video Report,” 18-34 year-olds are 77% more likely to be cord-nevers than average, and 67% more likely to be cord-cutters.

One out of six of these so-called ‘Millennials’ reports not watching any original TV series from traditional TV sets within the past 30 days. Since this is a key demographic for advertisers and content producers alike, it is clearly incumbent on the industry to go where this demographic is going. And that means investing in the new world of OTT services.

OTT, or ‘Over-the-Top’, TV services are delivered to viewers via the internet without the need for a traditional cable or satellite subscription. Who is watching via OTT? In a word, everyone. According to the Comscore report, about 4 in 10 households subscribe to a paid digital video subscription service. And this number increases substantially every year.

Viewers are turning to OTT TV for a variety of reasons, and those reasons often vary by demographic.

Comscore says that adults ages 55+ report being most likely to watch a TV episode on an OTT service because they missed it live. Meanwhile, Millennials are more likely to say that having to watch fewer ads is a major factor in their choice of OTT viewing.

One of the key differentiators between OTT and traditional pay TV is that OTT invites viewers to consume content on different platforms – and they do. Comscore found that viewers are watching OTT content on smart TVs, on tablets, on smartphones, on internet-connected TV devices such as Roku, Apple TV, Google Chromecast, and Amazon Fire TV Stick, on gaming consoles like the Xbox One and PlayStation 4, and on Internet-connected BluRay players – to name just a few!

Once again, usage of these platforms breaks down along demographic lines, with older viewers preferring to consume content on a traditional TV screen, and younger viewers being more willing to watch on a tablet, a laptop, or some other device.

Regardless of the choice of screen, one thing is clear: more and more viewers across all demographics are taking their viewing online. There is no question that OTT is the future of TV. But this exciting new future brings unique challenges.

Technological Challenges

The infrastructure of traditional cable and satellite TV is standardized, predictable, and well-understood. OTT, on the other hand, is anything but. With OTT, by definition, the content providers can no longer assume that their content is being delivered to a traditional TV screen. And any number of platforms and technologies may play intermediary between viewer and content provider. Fragmentation is the order of the day.

This situation presents real challenges for businesses entering the OTT space. Is the video being delivered on Flash? Silverlight? HTML5? What sort of connection and bandwidth is available: Fiber? Cable broadband? 4G? Is the end device a traditional widescreen TV? A laptop? A tablet? A smartphone?

OTT providers must cope with a multitude of scenarios. Simply targeting a single smartphone OS can be a daunting task. The book Multimedia Networks: Protocols, Design and Applications, by Hans W. Barz and Gregory A. Bassett, reports that in 2014 there were 18,796 different versions of the Android operating system seen in the wild!

These are very real technical challenges for viewer and service provider alike. In 2014, according to Barz and Bassett, viewers experienced video streams which failed to fully start 2.6% of the time. Buffering, where video pauses or slows so that additional video can be downloaded, was experienced over 28% of the time.

These numbers are averages, of course. In practice, researchers found extensive performance variation depending on platform and geography. For example, streaming Flash video in Australia was interrupted 1.79% of the time, while Silverlight video in Denmark was interrupted 0.26% of the time, and mobile streaming in Argentina buffered 7.63% of the time.

These issues represent a real challenge to OTT providers because research shows that 75% of OTT viewers are prepared to abandon a video stream if they are dissatisfied with it for more than four minutes. Modern OTT viewers expect a quality viewing experience. When they do not get one, they will quickly abandon a stream and even, potentially, a provider in search of a better experience. OTT providers need to be alert to the technical challenges offered by varying platforms, regions, and technologies.

Content Acquisition Challenges

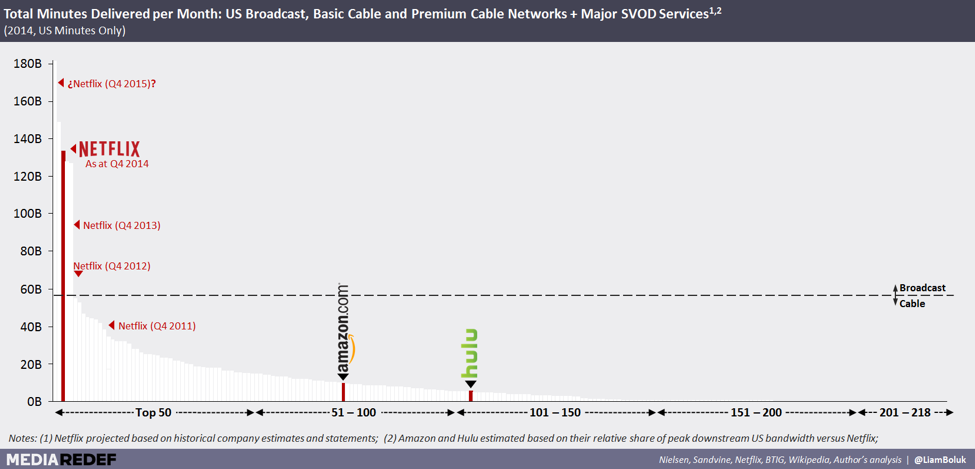

Today the number of OTT providers is proliferating rapidly. Some digital-only services now rival the largest cable networks. In the fourth quarter of 2014, Netflix ousted The Disney Channel, the industry’s largest cable network, in consumption of minutes by double. Recognizing the changing market landscape, more and more traditional pay TV providers are providing their content through an OTT service as well. In this crowded marketplace, it is important for new services to find ways to differentiate themselves to consumers.

The main reasons that consumers try a new OTT service are because:

- They have already watched the shows that initially attracted them

- Trial periods have ended

- The OTT provider has not done enough to provide ongoing perceived value

It is critical that a successful OTT service provides a broad spectrum of content, comparable in scope to what others are providing. In addition, services must offer unique or original content that differentiates themselves from the competition.

Whether you are creating it or acquiring it, content is expensive. The challenge for OTT providers is to find ways to provide a large amount of content, as well as compelling, unique content, at a price point that is affordable.

At the same time, content owners need to be wary of their existing relationships with TV service providers. According to an Ericsson white paper titled “Monetizing Over-the-Top,” content owners understand the possibilities of increasing viewership and advertising revenue, however, they “don’t want to disrupt their existing, important relationships with service providers.”

Popular content providers understand they are in something of a position of power, says the white paper, because they have content that is in high demand and that they can now share in a way that is consistent with consumer demand. Still, lucrative relationships with TV service providers add to the mix of challenges as stand-alone OTT apps provide competition to programming options that may also be featured by service providers.

Figuring out the mix of monetization models will certainly be an ongoing challenge for both sides of the content delivery companies, and these are discussed in more detail below.

Advertising & Monetization Challenges

With traditional Pay TV, advertisers had a simple model to follow: Program A attracted X number of viewers in demographic Y. So when advertisers bought ad time during Program A, they knew exactly what they were getting. Suddenly, however, many of Program A’s viewers are going online. Simply advertising during the live broadcast means missing out on many of them. But how to reach them?

The answer lies with Dynamic Ad Insertion, or DAI technology, which is rapidly evolving to become increasingly sophisticated. DAI now allows targeted ads to be inserted into live streamed broadcasts. These ads take into account the time allotted and the viewer’s demographic. Two different viewers watching the same stream can see two different ads in the same slot. No more cat food ads served to viewers who don’t own cats.

This is important not only because DAI can be used to target specific consumer groups, but also different geographic areas. A live sports broadcast can now feature ads from the viewer’s local sports affiliates, for instance. This makes digital advertising accessible to local businesses as well as the big players, opening up the market.

According to an article by Broadcast Beat Magazine titled “Dynamic Ad Insertion is Here,” DAI brings increased profit margins with reach as this technology allows content owners to:

- Target ad campaigns to any episode of any program

- Generate more revenue due to the ability to offer more free on-demand shows and the advertising reach this allows (see freemium model below)

- Utilize one piece of programming and sell varying types of advertising campaigns throughout its lifetime

- Update advertising in time for holidays, cross promotions or other current events

- Measure results more effectively

Additional OTT Monetization Models

Of course, ad revenue is by no means the only way of monetizing content. For content owners and service providers there are five major monetization models. They may choose to utilize one model exclusively or deploy a combination of them, according to Ericsson:

1. Subscription

Generally considered the most lucrative model for content owners and service providers, the subscription model tends to sit most favorably with consumers. Made popular by Netflix and piggybacked by Hulu, this model provides discerning consumers unlimited access to their content.The benefit to service providers is that revenue streams are predictable, but the start-up model is challenging. For the subscription model to be successful, as in the case of Netflix, these companies need to amass a large library of content to appeal to viewers. Some companies simply don’t have the investment capabilities to fuel this kind of library, meaning that following this model before delivering on the consumer demand for wide selections can have them fizzle out before they bring their subscriber base up to levels that will yield substantial margins.

2. Rental

The rental model targets viewers on an incremental basis for content that tends to be new. Used largely by cable providers (who offer VOD) and companies such as iTunes, typical media includes new movie or TV releases that can be watched on any device at any time.The obstacle of the rental model is that, unlike subscriptions, revenue streams tend to be less predictable as consumer demand for the newer content for companies who follow this model provide can be difficult to forecast.

3. Purchase

Similar to the rental model in that this monetization strategy targets consumers who want recent releases of hot movies or TV shows, the purchase model charges a premium because demand is high. Unlike the rental model, the purchase model provides viewers lifetime rights to content where they can access programs in their “cloud” libraries at any time or on any device. VUDU’s partnership with the film industry’s digital rights locker Ultraviolet is an example of this model.

4. Freemium-to-Premium Conversion

The freemium model works particularly well for customer acquisition as it is very accessible to subscribers that have not yet made a financial commitment but still want access to OTT content. Content providers that can convert subscribers from unpaid memberships over to premium ones can greatly benefit from this model with the right kind of content (such as free pilot episodes).Once the unpaid subscribers are baited with free content that they like, they are then converted to subscription-based members and the consistent revenue streams these types of viewers afford.

5. Advertising

According to a recent press release by Juniper Research, in-app advertising is forecasted to grow to $16.9 billion by 2018. This growth is driven, in part, by improvements in targeting (such as DAI, mentioned above) as well as a trend towards “more effective rich media ads.”

Juniper also reports that the existing trend in smartphone in-app ad spend, which currently accounts for about 70%, will likely be split down the middle with tablet ads by 2018. This is due to the findings that tablet in-app ad spend cost per 1,000 impressions (CPMs) are considerably more expensive than those of smartphones.

Overall, advertising spend within tablets and smartphones is expected to experience an annual growth rate of 24.6% from now until 2018 says Ericsson, reaching $39.3 billion. This market is particularly interesting to advertisers due to the opportunities that lie within targeted advertising. This type of contextually relevant targeting allows advertisers insight into the world of personalization not afforded with typical TV advertisement.

User-Paid or Advertiser-Paid?

With all these monetization models available, content creators must still rely on data to provide advertisers the most appetizing access to niche demographics. This data includes but is not limited to:

- Content metrics

- Device usage metrics

- Demographic metrics

Content creators must also become well-versed in how to mix user-paid and advertiser-paid monetization for maximum profitability.

Float Left provides its partners this type of metric-backed technology to help them determine the right balance of both, and understands and consults on the variances from network to network based on their business models.

User Experience and Programming Guides

In terms of user experience (UX), no better company comes to mind in the OTT world than Netflix. Their focus on UX has set the gold standard which other companies live and die by.

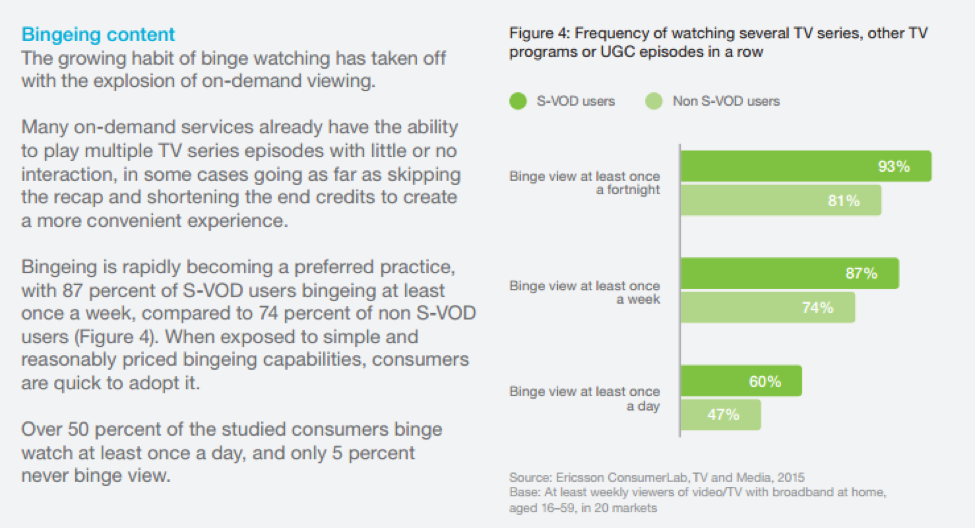

Netflix are pioneers in many ways: first, as a company founded at a time (1997) when home internet was still considered a novelty and Blockbuster still ruled our movie experiences. They have since become the biggest broadcaster in the world and are available in nearly every country in the world. They also essentially invented what is called “bingeflix,” the freedom of consumers to watch entire seasons as they please rather than waiting for individual episodes to be released.

Image source: Ericsson

This was first witnessed with their hit show House of Cards, also a milestone for the company in two ways: it was their first original series and the first time an entire season was released all at once. This, says an article referenced by Clickz, “allows the customer to drive their own experience.”

But Netflix is not the only company getting user experience right; most OTT-ready platforms provide UX guidelines and suggestions for developers. Take Android TV, for example, who provides basic guidelines on their site regarding home screen UX, content recommendations, search considerations, settings design and more. Apple’s tvOS takes it even further, with their tvOS Human Interface Guidelines, covering design principles, apps, focus, and parallax, and includes entire human interface recommendations based on remotes, user interaction, visual design, icons and images, interface elements and other resources.

However, the key to user experience, as most brands are finding, is not doing a one-and-done design for one OTT application (i.e. an app for Roku). It’s creating a brand-wide, unified experience across every device on any platform whether it be Smart TV, set-top boxes, gaming consoles, mobile devices, or any other streaming platform.

Part of this experience lends itself to the consumer expectation of the previously popular program grid to a personalized view of content that is adaptive to user history.

In fact, 62% of consumers aged 25-34 say that linear TV, where viewers are forced to watch a program at a specific time, can’t find anything to watch at least once a day.

These consumers feel that recommendation features are not intuitive or personal enough. This is likely due to their experience with platforms that are known for recommendation engines such as Netflix or YouTube, where user penetration is high at 52% and 71% weekly usage, respectively.

Piracy

Offering a terrific user experience and great, original content won’t matter much if viewers are getting that content elsewhere for free. Piracy continues to be a major challenge for OTT providers. Piracy tends to take a couple of major forms. There are pirates who break into the OTT provider’s system, pose as a legitimate user, and stream content for free to their own pirate sites or apps. And there are those who use the OTT service to ‘rip’ or download the content and distribute it via other means.

Traditionally Pay TV providers have used Conditional Access to make sure that only legitimate, paying subscribers are consuming their content. However, this requires end-to-end control of the network. For instance, in a traditional cable model, the subscriber uses a set-top box with an embedded smartcard to receive and decrypt the signal. With an OTT service, these assumptions are completely thrown out the window. Now the provider has no control over either the network or the end device. The network is the internet instead of a managed network. Smartphones, tablets and laptops do not contain broadcast tuners.

Online, the solution to content control has often been to use Digital Rights Management, or DRM, technology to secure content as it was being streamed or downloaded. Unlike with Conditional Access, the burden typically falls on the OTT provider to technically implement DRM. Depending on the level of expertise involved, this can result in wildly different levels of security.

Additionally, different platforms also require different types of DRM, each with their own unique needs and requirements. It can be challenging to build an OTT service that meshes with the ever-proliferating variety of DRM that is required. And at the end of the day, no DRM is completely bulletproof.

Failing to protect content means that that content will inevitably turn up in pirate torrents and on unlicensed streaming sites. But content protection that is overzealous or that doesn’t work well is a problem too. Consumers aren’t familiar with DRM and will place the blame squarely on the OTT service provider when their content fails to load!

Not all types of content are equally vulnerable to piracy. One of the attractions of broadcasting live events is that their value lies in the fact that they are in real time. Consumers are generally less interested in streaming them after they have concluded, which greatly reduces the incentive for piracy. Newer technologies such as 4K TV also boast more robust anti-piracy measures.

Subscriber Churn

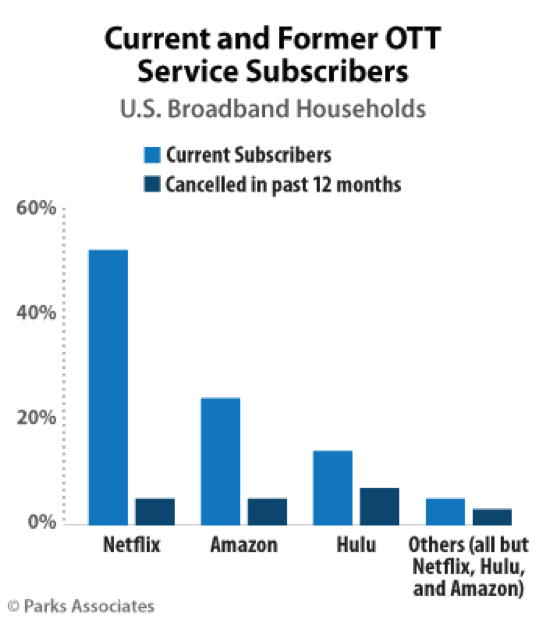

The OTT landscape is changing very rapidly. New players are entering the market constantly; new models are being tried out and sometimes discarded. There are a lot of options out there, and consumers are still discovering which ones they prefer.

Content, too, is moving around very rapidly. Right now we live in a world where content creators may license their content to big aggregators like Netflix or Hulu one month, only to pull it and offer it somewhere else, or on their own proprietary OTT service, the next.

Image Source: Parks Associates

Due to these factors, the base assumption is that subscriber churn will continue to be a real phenomenon. Subscribers may drop in, use a service for a period, and then drop out again. To counter this phenomenon, it is critical that OTT providers make their product as simple and hassle-free to try out as possible. It is also important to provide users with a smooth, frictionless experience. This way when they ‘churn’ out of other services, they will be more likely to return. Churn on other services can be your gain.

Infrastructure Challenges

Broadband infrastructure still represents a very real challenge to widespread OTT adoption. It is easy to forget that a large number of Americans live in areas that do not have access to sufficient bandwidth to enjoy OTT. Most of these areas are rural. Recent US government census data shows that nearly 60 million Americans, or 19.3 percent, live in areas that lack broadband infrastructure.

Of course in many places that supposedly have broadband internet, the bandwidth for enjoying quality OTT content is simply not there. So the census numbers may well understate the problem substantially.

It is critical for the growth of the OTT industry as a whole that OTT providers ensure the continued spread of high-speed broadband connections. New connections mean new customers. It is as simple as that.

It is also important to remember that ‘high-speed’ is a relative term, geographically. A good OTT service should ‘degrade gracefully’ on slower and sub-optimal connections.

Now We Know The Pitfalls. What Are The Solutions?

It is clear that OTT is not just the future of TV, OTT is the present of TV. Traditional Pay TV providers are finding that they need to get on board or be left behind. New entrants into the market are seeing exciting opportunities, in part, by the cord-cutters and cord-nevers.

But it’s also just as clear that there are numerous challenges and obstacles to surmount when launching an OTT service. You need not just technical expertise, but a deep understanding of a rapidly-evolving market landscape. For those who are new to OTT, this can present a daunting prospect.

Fortunately, there is help. Float Left was formed to help provide content providers the technologies needed to help them fuel the hunger for a better way to access programming. In addition to providing app development for mobile phones, tablets, streaming media players (Roku, Apple TV, etc), Smart TVs, and game consoles, Float Left has also developed a suite of solutions for providers who want to deliver best-in-class TV experiences directly to their viewers.

The Flicast and Flicast Premium solutions provide such features as TV on demand everywhere, a branded experience across all platforms, recommendation engines, custom playlists, cross-device resume, search, ratings, interactive ads, pre-integrations with 3rd-party solution vendors such as Adobe or Nielsen, and tracking and measuring analytical tools.